The Standard Formula: Solvency II for Insurers | Insights | Skadden, Arps, Slate, Meagher & Flom LLP

Solvency II. A comparison of the standard model with internal models to calculate the Solvency Capital Requirements (SCR) - GRIN

Article 178 Spread risk on securitisation positions: calculation of the capital requirement | Regulation 2015/35/EU - Solvency II Delegated Regulation | Better Regulation

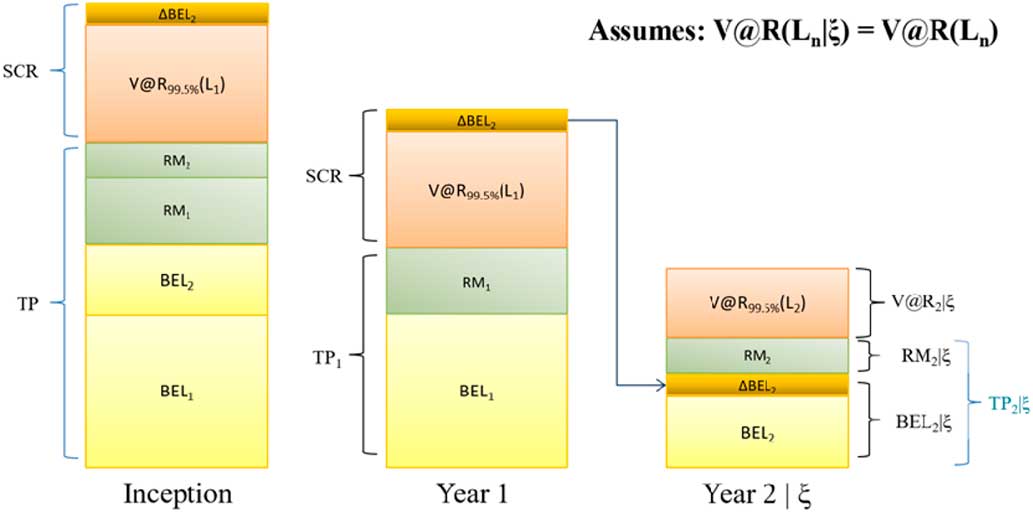

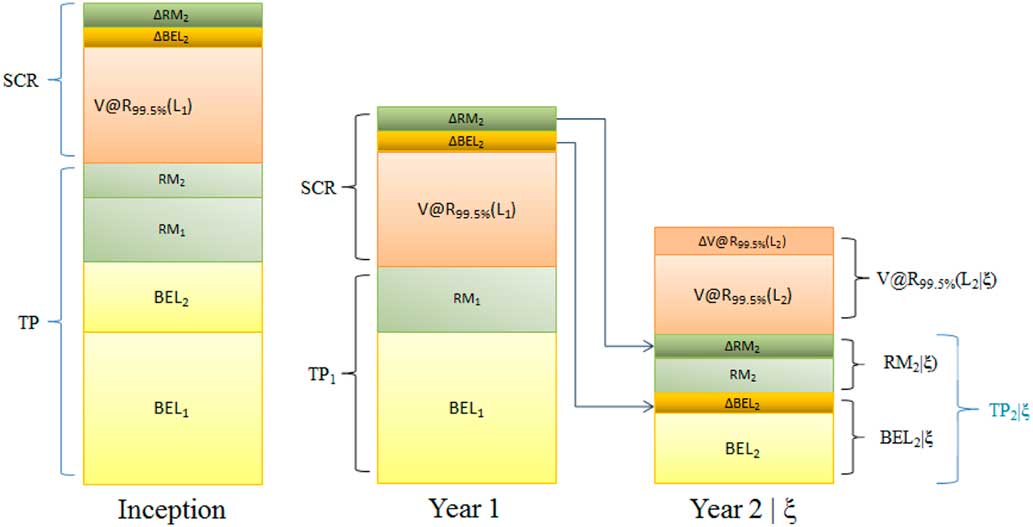

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

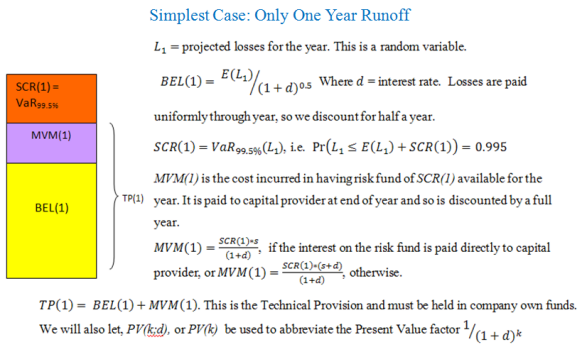

Insurance mathematics III. lecture Solvency II – introduction Solvency II is a new regime which changes fundamentally the insurers (and reinsurers). The. - ppt download